India’s Defence Exports Reach Record High

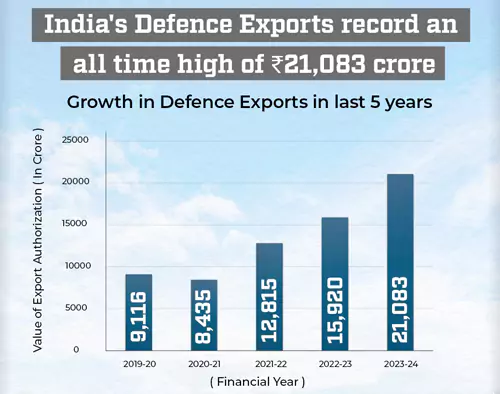

India's defence exports have reached an all-time high of ₹21,083 crore ($2.63 billion) in FY 2023-24, marking a 32.5% growth compared to the previous fiscal year. This achievement underscores India’s emergence as a global defence manufacturing hub, driven by policy reforms, technological advancements, and a push for self-reliance under Atmanirbhar Bharat.

With over 100 countries importing Indian-made defence equipment, the nation is rapidly transitioning from an arms importer to a major arms exporter. This shift is crucial for strategic autonomy, defence diplomacy, and economic growth.

Key Statistics & Growth Trends

| Metric | FY 2013-14 | FY 2022-23 | FY 2023-24 | Growth Rate |

| Defence Exports | ₹1,941 crore | ₹15,920 crore | ₹21,083 crore | 32.5% YoY growth |

| 10-Year Growth (2013-14 to 2023-24) | 31-fold increase | |||

| 20-Year Growth (2004-05 to 2023-24) | 21-fold increase (₹4,312 crore → ₹88,319 crore) | |||

| Defence Production | ₹46,429 crore (2014-15) | - | ₹1.27 lakh crore (2023-24) | 174% increase |

| Defence Budget | ₹2,53,346 crore (2013-14) | - | ₹6,21,940 crore (2024-25) | 145% increase |

| Export Authorizations Issued | - | 1,414 (2022-23) | 1,507 (2023-24) | Growing trend |

Future Targets

- ₹1.75 lakh crore defence production in 2024-25.

- ₹3 lakh crore defence production & ₹50,000 crore exports by 2029.

Key Contributors to Defence Exports

- Private Sector – Contributed 60% of total exports.

- Defence Public Sector Undertakings (DPSUs) – Contributed 40%.

The rise in exports has been primarily driven by the private sector, which has improved manufacturing capabilities through indigenous R&D, innovation, and government support.

Major Defence Export Destinations

India’s defence exports have expanded to over 100 countries. The top three buyers in FY 2023-24were:

- United States – Leading importer of Indian defence technology.

- France – Strategic partner with growing defence trade.

- Armenia – Major buyer of Indian missile systems.

Other notable buyers include Southeast Asian, African, and Latin American nations seeking cost-effective, reliable military equipment.

Key Defence Equipment Exported by India

India's export portfolio consists of a diverse range of advanced military platforms, weapons, and surveillance systems:

Missile Systems

- BrahMos Supersonic Cruise Missiles – Exported to the Philippines; negotiations underway with Indonesia, Vietnam, and UAE.

- AKASH Surface-to-Air Missile System – Interest from Southeast Asia & Middle East.

Aircraft & UAVs

- Tejas Light Combat Aircraft (LCA) – Interest from Malaysia, Argentina, and Egypt.

- Dornier Do-228 Aircraft – Exported to multiple countries.

- Indigenous UAVs (Drones) – Being explored for export to African and ASEAN nations.

Artillery & Rocket Systems

- Pinaka Multi-Barrel Rocket Launchers – Interest from Armenia & African nations.

Naval Platforms

- Fast Interceptor Boats – Supplied to Mozambique & Seychelles.

Armored Vehicles & Small Arms

- Bulletproof Jackets – Supplied to various countries; ‘Made in Bihar’ boots included in Russian Army equipment.

- T-90 & Arjun Tanks (potential future exports) – Interest from Egypt & Middle Eastern nations.

These exports reflect India’s expanding role in the global defence industry and its ability to provide cost-effective, high-quality defence solutions.

Key Policy Reforms Driving Growth

India’s defence export growth is the result of proactive government policies and strategic initiatives:

Atmanirbhar Bharat & Make in India

- Promotion of indigenous defence manufacturing to reduce dependence on imports.

- Incentives for private sector participation & startups in the defence industry.

Ease of Doing Business in Defence

- Simplified licensing & export procedures through the Srijan Portal.

- Increased Foreign Direct Investment (FDI) cap to 74% in the defence sector.

Government-to-Government (G2G) Defence Deals

- Direct export agreements between India and foreign nations (e.g., BrahMos deal with the Philippines).

Defence Production & Export Promotion Policy (DPEPP), 2020

- Aims to increase domestic defence production and streamline defence exports.

Strategic Partnerships with Foreign Nations

- Collaborations with USA, Russia, France, Israel for joint production and exports.

These initiatives have boosted investor confidence, encouraged domestic innovation, and positioned India as a key player in the global arms market.

Strategic Importance of India's Defence Exports

- Strengthening Strategic Partnerships – Defence exports improve diplomatic ties and India’s global influence.

- Economic Growth & Job Creation – Expansion of the defence sector boosts employment and GDP.

- Enhancing National Security – Reduced dependence on foreign arms strengthens India’s defence preparedness.

- Positioning India as an Alternative Supplier – Competing with USA, Russia, and China for arms exports.

Comparison of India’s Defence Exports with Global Arms Exporters

India has significantly increased its defence exports, reaching ₹21,083 crore ($2.63 billion) in FY 2023-24. However, to become a leading global arms supplier, India must compete with established players like the USA, Russia, China, and European nations.

This detailed comparison highlights India’s position in the global arms market and the challenges & opportunities ahead.

Global Ranking of Defence Exporters (2023 Data)

According to the Stockholm International Peace Research Institute (SIPRI), the top five defence exporters (2018-2023) were:

| Rank | Country | Share of Global Arms Exports (%) | Key Clients |

| 1 | USA | 40% | Saudi Arabia, Australia, Japan, UK |

| 2 | Russia | 16% | India, China, Egypt, Algeria |

| 3 | France | 11% | India, Egypt, Qatar |

| 4 | China | 5.2% | Pakistan, Bangladesh, Thailand |

| 5 | Germany | 4.5% | South Korea, Israel, UK |

| (Emerging) | India | 1.6% | USA, France, Armenia, Southeast Asia |

- India ranks among the top 25 arms exporters but still has a small share (1.6%) of the global market compared to USA, Russia, and France.

- The USA dominates with a 40% share, while Russia is declining due to the Ukraine war.

- India’s potential for growth is strong, given its rising exports & strategic partnerships.

Country-Wise Defence Export Comparison

United States – The Global Leader

- Biggest arms exporter (40% market share).

- Sells high-tech weapons, including fighter jets, missiles, and submarines.

- Top clients: Saudi Arabia, Australia, Japan, UK.

- Uses strong defence alliances (NATO, QUAD, AUKUS) to expand exports.

Challenges for India: Competing with USA’s advanced

technology & global

reach.

Opportunities:India-USA defence

cooperation is growing (e.g., GE-F414 jet engine deal).

Russia – Declining Market Share

- Was India’s top defence supplier for decades.

- Specializes in fighter jets (Su-30, MiG), tanks (T-90), and missiles (S-400).

- Losing market share due to sanctions & Ukraine war.

Challenges for India: Reducing dependence on Russian

weapons while maintaining

ties.

Opportunities:India can replace Russia in global

markets like Egypt & Vietnam.

France – India’s New Strategic Partner

- Growing defence exports (11% market share).

- Major supplier of Rafale fighter jets, submarines, and helicopters.

- India is a key buyer – Rafale jets for IAF & Navy, Scorpène submarines.

Challenges for India: Competing with France’s high-quality

defence exports.

Opportunities:India-France

joint production (e.g., Rafale M for Indian Navy).

China – India’s Regional Competitor

- Exports low-cost weapons to Pakistan, Bangladesh, and Africa.

- Focuses on drones (Wing Loong), missiles, and fighter jets (JF-17, FC-31).

- Dominates in Asia & Africa due to cheaper pricing.

Challenges for India:Competing with China’s cost-effective

defence exports.

Opportunities: India can

counter China in Africa, Southeast Asia & Middle East with

better-quality defence products.

Strengths & Weaknesses of India’s Defence Exports

| Factor | India’s Strengths | India’s Weaknesses |

| Government Policies | Atmanirbhar Bharat & Make in India promote domestic production. | Export procedures still complex & bureaucratic. |

| Technology & R&D | Growing indigenous capabilities (Tejas, BrahMos, Pinaka). | Lags behind USA, Russia, and France in advanced technology. |

| Market Expansion | Entering new markets like Armenia, Southeast Asia & Middle East. | Needs stronger marketing & strategic alliances. |

| Pricing | More affordable than Western weapons, higher quality than Chinese ones. | Still not as cost-effective as China’s defence products. |

| Defence Diplomacy | Strategic ties with France, Israel, Russia, and USA. | Needs more government-to-government (G2G) deals. |

- India’s biggest advantage is that it offers affordable, high-quality defence products, bridging the gap between expensive Western weapons & cheap Chinese alternatives.

- However, India needs to improve technology & streamline export approvals to compete with major players.

How India Can Compete with Global Defence Exporters

Expand Strategic Defence Partnerships

- Strengthen India-USA, India-France, and India-Israel ties for joint defence production.

- Use India’s position in BRICS & QUAD to expand exports.

Boost Indigenous Defence Manufacturing

- Develop advanced fighter jets, submarines, and drones to match global standards.

- More funding for DRDO, HAL, and private defence startups.

Improve Export Policies & Regulations

- Faster export clearance through a single-window system.

- Increase Foreign Direct Investment (FDI) in defence to attract global firms.

Target New Defence Markets

- Expand exports to Africa, Latin America, Southeast Asia, and Middle East.

- Offer long-term maintenance & training packages to buyers (like the USA & France).

Compete with China’s Low-Cost Defence Equipment

- Use economies of scale to reduce production costs.

- Offer financing options & credit facilities to attract smaller nations.

Challenges in Defence Exports

- Dependence on DPSUs for Major Projects – Need for more private sector participation.

- High Global Competition – USA, Russia, and China dominate global arms exports.

- Bureaucratic Hurdles – Export approval processes can be slow and complex.

- Limited High-End Technology – Need for stronger R&D investments to develop next-generation weapons.

India must address these challenges to sustain its growth in defence exports and compete globally.

The Road Ahead: Strategies for Future Growth

Future Outlook – India’s Defence Export Targets

- ₹50,000 crore defence exports by 2029 (compared to ₹21,083 crore in 2023-24).

- Increase share in global defence exports from 1.6% to 5% by 2035.

- Become a key supplier of missiles, fighter jets, and naval platforms.

If these targets are met, India can become a TOP-5 global arms exporter by 2035.

- Strengthening R&D & Innovation – More investment in indigenous defence technology.

- Expanding Defence Diplomacy – Stronger bilateral defence agreements with new markets.

- Boosting Private Sector & MSMEs – Incentivizing startups & small businesses in defence manufacturing.

- Achieving ₹50,000 Crore Export Target by 2029 – Making India a leading global arms supplier.

India’s defence exports have reached an all-time high, marking a new era in self-reliance and global defence trade. With record-breaking production, increasing demand, and strong government backing, India is on track to becoming a major arms exporter.

However, to sustain this momentum, India must focus on technology advancements, streamlining export policies, and building strong global partnerships. If these goals are met, India can emerge as one of the world’s top defence manufacturers by 2030.