India’s Carbon Market & Carbon Sink

With climate change intensifying, India, the third-largest emitter of greenhouse gases (GHGs), is taking strong steps to mitigate emissions through carbon markets and carbon sink enhancement projects. These efforts are aligned with India's commitment to achieving net-zero emissions by 2070 under the Paris Agreement.

Why Are Carbon Markets & Carbon Sinks Important?

- Reduce Carbon Emissions: Help industries and companies control their CO₂ footprint.

- Encourage Green Technology: Provides economic incentives for industries to adopt clean technologies.

- Enhance Natural Carbon Absorption: Forests and oceans play a key role in absorbing CO₂.

- Attract Green Investments: Encourages private sector participation in sustainable development.

Key Focus Areas in 2024-2025:

- Operationalizing the Indian Carbon Market (ICM) for large industries.

- Expanding afforestation & reforestation programs to increase carbon sink capacity.

- Researching Carbon Capture & Storage (CCS) to curb industrial emissions.

- Developing carbon credit trade mechanisms under international climate agreements.

Understanding Carbon Markets & India’s Approach

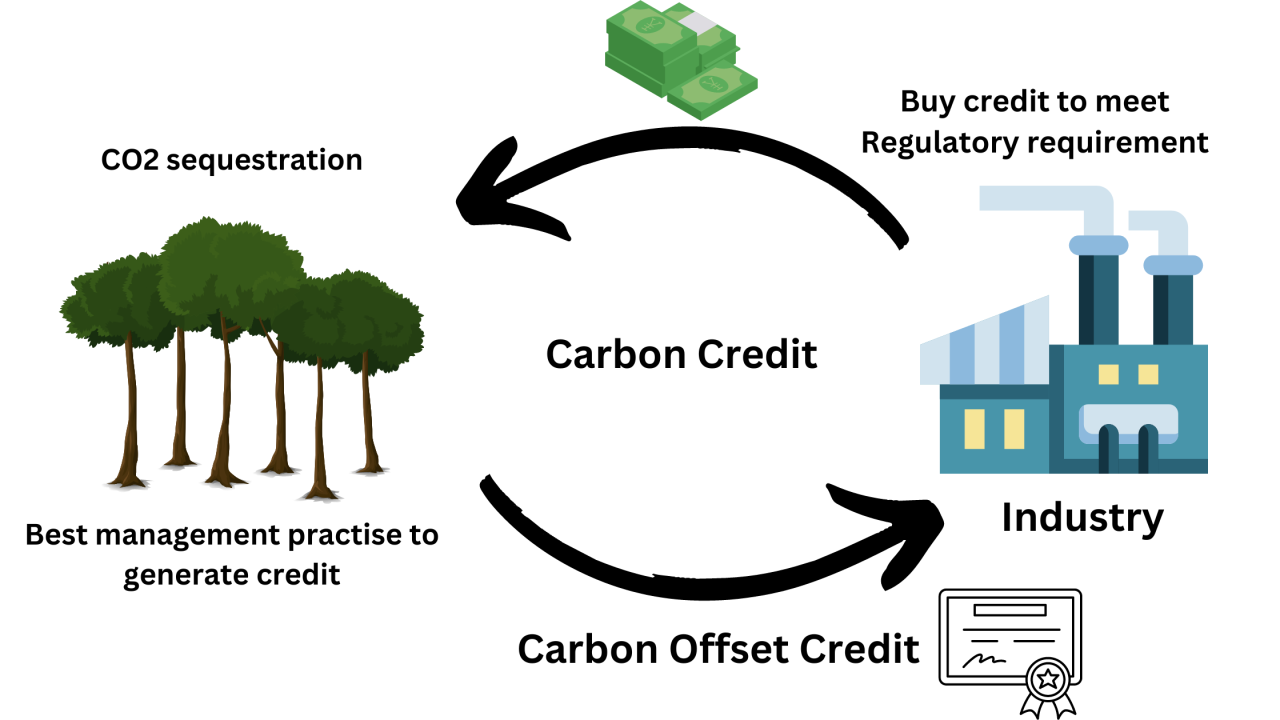

What is a Carbon Market?

A carbon market is a system where businesses buy and sell carbon credits to compensate for their emissions. It helps reduce emissions cost-effectively by putting a price on carbon pollution.

There are two types of carbon markets:

| Type | Description | Example |

|---|---|---|

| Cap-and-Trade Market (Compliance Market) | The government sets a carbon emission cap. If a company emits less CO₂ than allowed, it can sell its extra carbon credits to others who exceed their limit. | European Union Emission Trading System (EU ETS), US California Cap-and-Trade Program |

| Voluntary Carbon Market | Businesses & individuals voluntarily buy carbon credits to offset their emissions. This market is not legally required but helps companies achieve carbon neutrality. | Google & Microsoft buy carbon credits to offset emissions. |

What is a Carbon Credit?

A carbon credit represents 1 metric tonne of CO₂ reduced or

removed from the atmosphere.

Companies that emit less

CO₂ can sell their extra credits, while high-emission

industries must buy credits to comply with environmental regulations.

How Do Carbon Markets Work? (Step-by-Step Process)

- The government sets an emission limit for industries.

- Companies monitor & report their CO₂ emissions.

- If they emit more than allowed, they must buy carbon credits.

- If they reduce emissions, they can sell their extra carbon credits.

- Credits are traded on a carbon exchange platform.

India’s Carbon Market Developments (2024-2025)

Indian Carbon Market (ICM) – Launched in 2023

- First official carbon trading cycle began in 2024.

- Industries from power, steel, cement, and oil & gas sectors participated.

- Tata Steel, NTPC, and Adani Green Energy traded carbon credits.

2024-2025 Developments in India’s Carbon Market

- Carbon Credit Pricing Framework launched in January 2024.

- First Carbon Exchange for Industry-Linked Trading established.

- Expansion of Carbon Trading to Medium-Sized Businesses (Expected 2025).

- Government considering linking India’s market to International Carbon Trading platforms (2025).

Future of India’s Carbon Market (2025 & Beyond)

- Mandatory participation for all high-emission industries by 2025.

- Introducing carbon pricing for transport & aviation sectors.

- Integrating carbon markets with renewable energy projects (solar, wind).

Understanding Carbon Sinks & India’s Forest-Based Initiatives

What is a Carbon Sink?

A carbon sink is a natural system that absorbs more CO₂ than it emits. It helps remove carbon from the atmosphere, mitigating climate change.

Types of Carbon Sinks

- Forests & Mangroves – Trees absorb CO₂ through photosynthesis.

- Soil & Wetlands – Capture and store carbon in organic matter.

- Oceans & Seagrasses – Store CO₂ through marine life absorption.

India’s Carbon Sink Expansion Projects (2024-2025)

Project Name

Location

Objective

Mangrove Mitra Initiative

(2024)

West Bengal, Odisha,

Gujarat

Expanding mangrove

forests to store CO₂.

Green Cities Project

(2025)

Delhi, Mumbai,

Bangalore

Urban forestry & rooftop

gardens to improve air quality.

Aravalli Reforestation

Project (2024)

Rajasthan, Haryana

Restoring degraded forest

lands to absorb carbon.

India’s Commitment to Expanding Carbon Sinks

- Goal: Increase forest cover to sequester 2.5–3 billion tonnes

of CO₂ by 2030.

- National Afforestation Programme (NAP) & Green India

Mission expanding in 2024.

- Mandatory tree plantation programs launched for industrial

zones in 2025.

Carbon Capture & Storage (CCS) Research in India

What is Carbon Capture & Storage (CCS)?

| Project Name | Location | Objective |

|---|---|---|

| Mangrove Mitra Initiative (2024) | West Bengal, Odisha, Gujarat | Expanding mangrove forests to store CO₂. |

| Green Cities Project (2025) | Delhi, Mumbai, Bangalore | Urban forestry & rooftop gardens to improve air quality. |

| Aravalli Reforestation Project (2024) | Rajasthan, Haryana | Restoring degraded forest lands to absorb carbon. |

Carbon Capture & Storage (CCS) is a technology that traps CO₂ emissions from industrial facilities and stores them underground to prevent it from entering the atmosphere.

How Does CCS Work?

- Capture: CO₂ is captured at industries before it is released into the air.

- Transport: The CO₂ is compressed and transported via pipelines.

- Storage: CO₂ is stored in underground geological formations (e.g., deep-sea reservoirs).

CCS Projects in India (2024-2025)

- NTPC & ONGC exploring CO₂ storage in deep-sea reservoirs.

- IIT Bombay developing carbon utilization techniques (converting captured CO₂ into biofuels).

- BHEL launched India’s first CCS pilot plant (2025) for power plants.

India’s International Collaborations in Carbon Markets & Carbon Sinks

| Country/Organization | Collaboration Type |

|---|---|

| European Union (EU) | India in discussions for cross-border carbon trading. |

| United Nations REDD+ Program | India receives funding for forest-based carbon sink projects. |

| UAE & Saudi Arabia | Joint research on carbon capture technologies. |

Challenges in India’s Carbon Market & Carbon Sink Development

| Challenge | Impact | Solution |

|---|---|---|

| Carbon Market Pricing Issues | Carbon credits undervalued due to market uncertainty. | Establish strong pricing frameworks & mandatory trading. |

| Deforestation & Land Degradation | Lowers carbon sink capacity. | Strict forest conservation laws & afforestation programs. |

| Lack of CCS Infrastructure | High cost of CO₂ capture technologies. | Government incentives & private sector funding. |

Comparison of India's Carbon Market vs Global Markets

| Feature | India (ICM) | European Union (EU ETS) | China’s Carbon Market | US Cap-and-Trade (California) |

|---|---|---|---|---|

| Launch Year | 2023 | 2005 | 2021 | 2013 |

| Market Type | Compliance & Voluntary | Compliance | Compliance | Compliance |

| Industry Coverage | Power, Steel, Cement | Power, Aviation, Industry | Power, Manufacturing | Power, Transportation |

| Carbon Price (2024) | ₹700–₹1,500 per ton | €90 per ton | ¥50 per ton | $28 per ton |

| Mandatory Trading | No (voluntary for now) | Yes | Yes | Yes |

India’s Market is still in its early stages but could soon become mandatory for major industries.

Real-World Examples of Carbon Trading in India (2024-2025)

- Reliance Industries & Tata Steel: Participated in the first voluntary carbon credit auction in 2024.

- Adani Green Energy: Sold carbon credits from its solar and wind energy projects.

- NTPC (National Thermal Power Corporation): Purchased carbon credits to offset its coal-based emissions.

India’s Afforestation & Carbon Sink Initiatives

How Are Carbon Sinks Funded?

| Funding Source | Program | Objective |

|---|---|---|

| Government Funds | Compensatory Afforestation Fund (CAF) | Restores forest lost to development. |

| Private Investment | Corporate Social Responsibility (CSR) in Reforestation | Industries invest in forests to offset emissions. |

| International Support | UN REDD+ Program | Global funding for afforestation. |

| Carbon Credit Sales | Green India Bonds | Raising funds through carbon credit markets. |

Breakdown of India's Major Afforestation Programs

| Program Name | Objective | Recent Developments (2024–2025) |

|---|---|---|

| Green India Mission | Increase forest/tree cover by 10 million hectares. | ₹3,000 crore funding approved for 2024–2026 phase. |

| National Adaptation Fund for Climate Change (NAFCC) | Helps communities adapt to climate change. | 15 new projects launched for agroforestry. |

| Mangrove Mitra Initiative | Expanding mangrove cover in coastal areas. | 1,500 hectares of mangrove plantations in Odisha & Gujarat. |

| Urban Forestry Scheme | Promotes city-based tree plantations. | Rooftop and vertical gardens included in urban planning laws. |

India aims to remove 2.5-3 billion tonnes of CO₂ from the atmosphere by 2030 through afforestation!

India's Carbon Capture & Storage (CCS) Research

Advanced CCS Technologies Being Researched in India

| CCS Method | How It Works | India’s Research |

|---|---|---|

| Post-Combustion Capture | Captures CO₂ after burning fossil fuels. | BHEL pilot plant in Tamil Nadu. |

| Pre-Combustion Capture | Captures CO₂ before fuel is burned. | IIT Bombay exploring hydrogen-based CCS. |

| Bio-CCS (BECCS) | Uses plants to absorb CO₂, then stores emissions underground. | NTPC testing bio-CCS in Rajasthan. |

By 2030, India aims to store 500 million tonnes of CO₂ underground using CCS.

International Collaborations & Carbon Credit Trading

| Country/Organization | Partnership Focus | Status (2024-2025) |

|---|---|---|

| European Union (EU) | Carbon credit trade negotiations | India in talks to link ICM with EU ETS. |

| United Nations (REDD+) | Forest-based carbon projects | India received $80 million for afforestation. |

| UAE & Saudi Arabia | CCS and Green Hydrogen | Joint R&D projects on carbon storage. |

India is positioning itself as a global carbon credit supplier by 2025!

India’s Net-Zero Strategy

India’s carbon market & carbon sink research are crucial for reducing emissions while ensuring economic growth. The Indian Carbon Market (ICM), afforestation projects, and CCS research are laying the foundation for a low-carbon future.

India must continue strengthening carbon pricing, investing in green technologies, and integrating international carbon credit trade to become a global climate leader.